In every sector, customer churn is a constant challenge. For one reason or another, customers switch to competitors, they stop subscribing, or buying the products and services they used to purchase regularly.

Customer lifetime value (CLTV) is one of the most widely accepted ways to measure the long-term value of customers, in most sectors. Churn cuts into this, reducing it, costing businesses money.

Although churn is normal, as every business loses a percentage of its customers every year, the aim is always to keep this number as low as possible. Business leaders are always looking to understand why customers stop spending. Growth-based activities — sales, account management and marketing — should always counteract losing a percentage of the annual customer-base.

Why is churn a problem for businesses?

Churn forces sales teams, branch staff, and marketing departments to work harder to replace former customers, and the revenues from them. Traditional — usually questionnaire-based methods for understanding churn — only get you so far.

Which is why we have put together an academic study, developing using a machine-learning (ML)-based approach to help businesses understand (alternatively: better deal with the churn problem) this using the data they already have: “A Hybrid Two-Level Support Vector Machine-Based Method for Churn Analysis”, Ferdi et al, presented and published in ICCBDC 2021, produced in collaboration with BuboAI, we have taken this one step further.

Bubo.AI customer churn study analysis

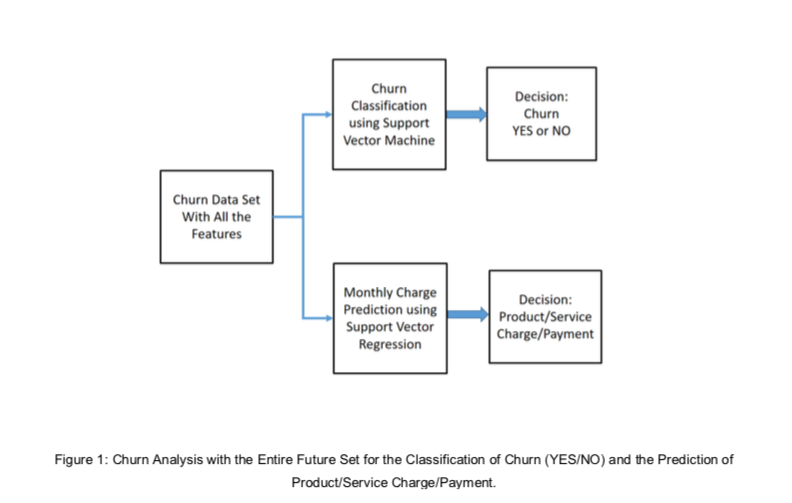

In order to achieve the desired analysis, a machine learning method, namely support vector machine (SVM), was used to intelligently identify if the customer is churned or not, for the classification part; whereas, a monthly service charge was predicted by using a support vector regression (SVR) method. The latter study was particularly important to understand how much the customer has paid for, and potentially predict ‘willingness to pay’ for the service.

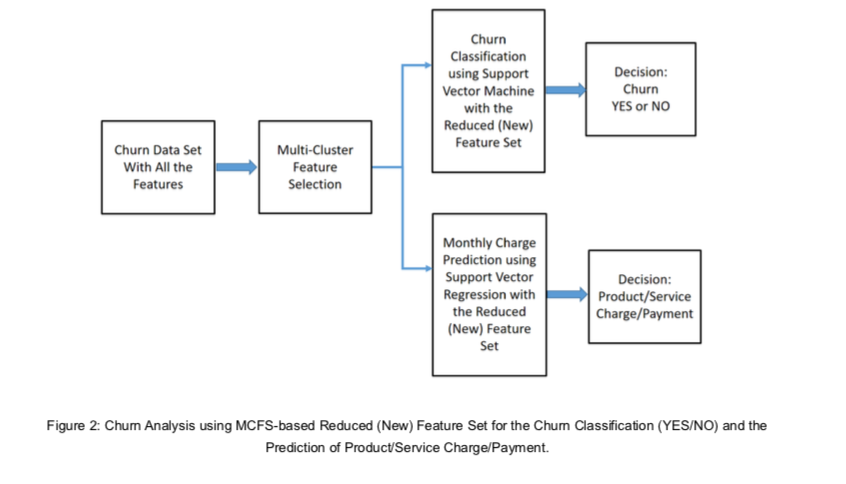

As a way of further improving the performance of both approaches, a multi-cluster feature selection (MCFS) method was utilized to select the most appropriate sub-set of the features that characterize the churn.

The data used in this hybrid study is based on the IBM Telco Customer Churn database with over 7,000 customers. A multi-cluster feature selection (MCFS) method was utilized for the analysis.

Figure 1 Churn Analysis with the Entire Future Set for the Classification of Churn (YES/NO) and the Prediction of Product/Service Charge/Payment

Statistically, the SVM-based classification method yielded an Area Under the Curve (AUC) of 85.6%, and an accuracy of 81.5%, which is higher than in earlier any current studies. At the same time, an SVR-based prediction of the monthly charge has resulted in Root-Mean-Square Error (RMSE) of 1.27, which is acceptable given the data set and sector.

A statistical analysis of the data shows that customers in this data set pay a wide range of fees, in total and monthly charges. Also, according to the data, female customers have paid more than male, with other features balanced between both genders.

Figure 2 Churn Analysis using MCFS-based Reduced (New) Feature Set for the Churn Classification (YES / NO) and the Prediction of Product/Service Charge/Payment

Conclusions

Based on this analysis of the data, we have been able to identify the following and draw these conclusions:

- Classify more accurately the churned customers;

- While also identifying exactly what the churned customers were paying (within a scale of the average mean, monthly and annual charges);

- Using SVM and SVR, customers can be profiled more accurately, which is useful when it comes to understanding who may or may not churn, and how much that customer is likely to pay for the service.especially when it comes to the monthly rate they pay.

- Within the profile, for these customers in the data set, is a clear understanding of the products/services used;

- And therefore, from an analysis of this data, a potential prediction as to whether customers are likely to churn, or not.

Key Takeaways

Once companies have this information, and can track customer data in real-time, they can aim to reduce churn by implementing an effective and profitable customer retention programme. Alongside customer retention programmes, value-driven pricing is also a useful way to retain more customers and ensure you are generating as much profit from them as possible.

Bubo.AI: Find out more about our cutting-edge award-winning AI solutions, that will help companies generate more revenue and higher profits, thanks to our customer value-based pricing products and services.

Notes

Academic reference: “A Hybrid Two-Level Support Vector Machine-Based Method for Churn Analysis”, Ferdi et al, ICCBDC 2021

This study was produced in collaboration with:

Dr. Ferdi Sarac, Suleyman Demirel University, Isparta, Turkey

Dr. Huseyin Seker, Bubo.AI Chief Data Scientist and Academic Adviser; Associate Dean (Research and Enterprise), Faculty of Computing, Engineering and the Built Environment (CEBE), Birmingham City University

Marcin Lisowski, Customer Success Director, Bubo.AI

Alan Timothy, CEO, Bubo.AI

For references, we are always happy to send the complete study.